How to Get Cheap Car Insurance With No Deposit

When you store for a new car insurance coverage, many insurers will rate more to your first month's charge, that's known as the deposit. Some drivers will qualify for no-deposit car insurance, because of this that your first month is similar to or cheaper than the subsequent months.

How no-deposit car insurance works

When you begin a new car insurance coverage, you may have the choice of paying month-to-month. For a few drivers, the primary charge might be extra high priced than the following month's bills, and this distinction is known as the deposit or down charge. The deposit is carried out towards destiny months' charges and encourages you to keep insurance with the corporation thru the duration of your coverage.

No-deposit car insurance way your first month is similar to or cheaper than the subsequent months. The length of the deposit, or more quantity to your first charge, relies upon on elements like your car, using records and state. In general, humans with secure using histories and excessive credit score ratings are maximum possibly to qualify for no-deposit or low-deposit car insurance.

No-deposit car insurance isn't always a particular coverage presented through insurance companies, and it does not imply you will be capable of get car insurance with out buying the primary month.

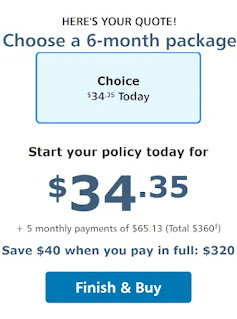

Sample quote with no deposit

When you get a quote, you may frequently see 3 numbers to consider:

- Deposit/first month value

- Monthly routine value

- Cost to pay in full

Progressive's quote web page breaks down your first month's value, month-to-month bills and general top rate for a no-deposit car insurance coverage:

In this example, in case you selected to pay for month-to-month car insurance with no deposit, you would pay $34.35 to your first month and $65.thirteen in keeping with month for the following 5 months. Your six-month top rate could be $360.If you desired to pay in even installments instead, your month-to-month invoice will be the identical each month, $60.

If you would paid for all six months in advance, your six-month top rate could be $320, which breaks down to $fifty three in keeping with month. You'd keep $forty through paying up front.

Companies with the cheapest no-deposit car insurance

Not each car insurer gives very cheap car insurance with no deposit. Geico, Progressive and State Farm all had low or no deposits, primarily based totally on sample quotes for a motive force with a great using records. In fact, Progressive presented a decrease fee for the primary month than for the subsequent months.

Most insurers additionally rate a small price to make month-to-month bills. Of the 3 foremost insurers we compared, handiest State Farm charged the identical quantity whether or not you pay charges in month-to-month installments or a lump sum.

One disadvantage to paying a decrease top rate to your first month is that your month-to-month value will move up after the primary month. The general value of your coverage isn't always unfold out evenly, so that you'll come to be paying barely extra after the primary month. Make positive you could find the money for the following month's charge or you may chance having your coverage canceled for nonpayment and turning into uninsured.

Who can get no-deposit car insurance

Not every body might be capable of get cheap car insurance with no deposit. In general, a motive force who's visible as low-chance could have a decrease insurance deposit or no deposit and cheaper month-to-month rates. How a lot you may need to spend to start insurance relies upon at the identical elements that move into your insurance rates, which encompass your state, car, using document and credit score rating.

Depending at the insurer and your chance elements, your first month should value similar to or much less than the following months, or you may pay everywhere from some greenbacks more to a widespread fraction of your general top rate — as much as 30%. A excessive-chance motive force with a bad credit score rating or more than one preceding claims or injuries will possibly be at the better stop of that scale.

How to join no-deposit car insurance

If you need to pay your car insurance in month-to-month installments and discover a no-deposit or low-deposit coverage, begin through getting loose car insurance quotes and evaluating expenses from more than one companies.

1. Set your budget

Figure out how a lot you could find the money for to pay for car insurance every month. From there, you could calculate the insurance you could find the money for.

2. Get quotes

Start through getting more than one quotes from the cheapest companies you could locate. Fill out information approximately yourself, your car and your using records to get accurate quotes online. Once you've got gotten quotes, evaluate your first month, month-to-month and general expenses facet through facet to ensure you are getting the quality deal.

3. Set up bills to begin your coverage

Most companies will can help you pay your car insurance invoice with digital budget transfer (EFT), credit score card, debit card or check. Some companies will rate a further price for sure methods, so maintain that during thoughts earlier than selecting your charge method.

Once you've got obtained your quote, you could usually buy your car insurance instantly. Most insurers provide instant car insurance with no deposit, which means you could get insurance the identical day as quickly as your charge is processed.

Simplify switching car insurance

Switching car insurance companies can bring about a few large savings, however it has a further value on the beginning: You need to pay to your new car insurance earlier than your new coverage ends. You can request money back out of your antique insurer, however it could take some time to obtain. Luckily, there are a few matters you could do to make the method simpler to your financial institution account:

- Cancel your antique coverage proper after signing up to your new one: Car insurance refunds take time to method, so that you need to cancel your antique coverage proper after your new coverage is in effect.

- Pay with a credit score card: Unlike different bills (like your car charge), you could pay for car insurance the usage of your credit score card, when you have one. Doing this indicates the cash you spend on insurance might not sincerely go away your financial institution account for approximately a month when you pay your invoice. Paying your current insurance invoice with a card can also assist you get your refund quicker than having your insurer mail you a check.

- Save your quote for later: If you discover a top notch fee for car insurance however do not have the cash proper away, you could keep the quote for later. Most insurers can help you keep a quote for as a minimum 30 days, however a few insurers can help you keep it for a lot longer — for example, Progressive helps you to keep a quote for as much as thirteen months.

Is no-deposit car insurance a rip-off?

Since no-deposit car insurance isn't always a time period often utilized by respectable car insurance companies, the word is now and again utilized by disreputable companies in deceptive or puzzling ways.

Car insurance companies will now no longer offer instant insurance earlier than you've got paid for it. Be cautious of companies that declare you could "purchase now, pay later" or get your first month loose.

First-month-loose gives

Your coverage is usually now no longer energetic till an insurer has evidence of charge. Companies that promise "$zero down" car insurance may be scamming you to get your non-public information, or they may provide you a deal it's too true to be authentic and take your cash later with out supplying you with an real coverage in exchange.

Paying for quotes

Another rip-off is requiring a deposit to get a car insurance quote. If an insurance corporation or agent states or implies it is usual to rate for an insurance quote, that is a pink flag approximately that corporation's trustworthiness. No foremost car insurance companies would require a deposit or price for a quote.

Temporary car insurance

If you cannot locate cheap no-deposit car insurance, you is probably tempted through companies claiming to provide temporary car insurance. But respectable insurers do not usually sell car insurance for much less than six months. The quality manner to get car insurance for a quick length is to pay month-to-month, when you consider that you could cancel and transfer at any time and obtain money back for any charges you've got already paid in advance.

Comments